Disrupting the financial space, one idea at a time

The Foreign Billing Tool helps in the clearing and settlement of transactions processed outside of the Netherlands, as well as with the invoicing of the transaction fees of foreign accounts. iDEAL connectors, once integrated within a web shop, enable merchants to offer iDEAL as a payment method.

View case study

Maxconnect

With years of experience on products based on the 4-corner model, as well as on building test tools for these protocols, Maxcode has designed a tool that would give merchants the full end-to-end experience of an authentication flow using iDIN on their webshop. The test tool simulates the iDIN process fully, on both the acquirer and the issuer side and consists of a set of scenarios allowing you to test your iDIN software integration.

View case study

Surfnet takes part in iDIN pilot

SURFnet asked Maxcode to add iDIN as strong authentication method to SURFconext, because they wanted to join the iDIN pilot organised by Dutch Payments Association.

View case study

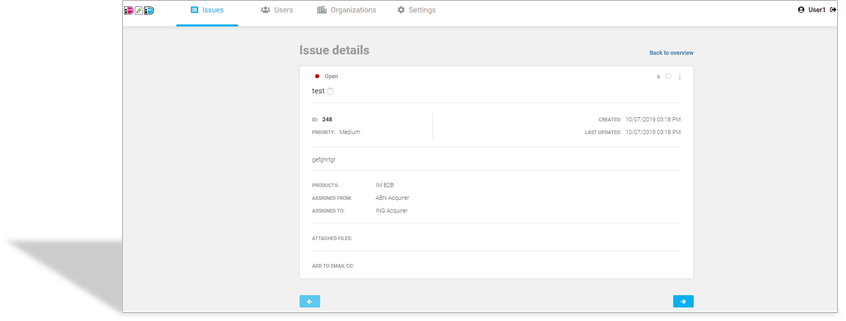

Currence Tools

Is a platform used by clients which are part of the Dutch banking system. They use this application to notify other participants on unavailibilities or possible issues that can appear on products such as iDEAL or iDIN. The application is based on multiple old sub-platforms that have been reconstructed on a newer platform using .NET Core 2.0 and Angular 7 helping customers to have access to friendlier UI, a more secure and faster notification system.

View case study

iDEAL Availability

The number of iDEAL transactions is constantly increasing. More and more merchants, consumers, and companies that offer payment services rely on its availability. Some initiatives were launched claiming to measure and report iDEAL’s availability. Consequently, the press started quoting these findings. However, it's not that simple to pinpoint the exact cause or consequence of disturbances related to iDEAL, since for every payment a staggering amount of information is exchanged between four actors in the iDEAL protocol.

View case study

MyBank

MyBank is one of the fastest growing new online payment solutions in the European market. The MyBank product was launched in 2013 after an initial pilot in Italy. Currently, 140+ banks in 3 countries actively support MyBank. The product is owned by Preta, a new organization founded in 2014 and controlled by EBA CLEARING.

View case study